AI Amazon Repricer

Boost your Amazon profits and avoid price wars with AI repricing

With Digital Services Tax (DST) laws in most countries, tech and eCommerce companies have likewise introduced additional fees for digital products or services.

With Digital Services Tax (DST) laws in most countries, tech and eCommerce companies have likewise introduced additional fees for digital products or services. Amazon, in particular, will implement a Digital Services Fee (DSF) starting next month, October 1, 2024.

Understanding the digital services tax and digital services fee is crucial for anticipating and preparing for the upcoming Amazon fee changes. Here are some essential things you should know.

Before discussing Amazon’s upcoming digital services fee, it is essential for you, as an Amazon seller, to understand the concept of digital services tax (DST). Understanding DST ensures you are well-informed and proactive in preparing for the changes ahead.

DST is a global tax initiative governments impose on certain digital services provided by multinational technology giants like Amazon, Google, and Facebook. This tax is levied on the gross revenues generated from online activities such as advertising, digital sales, and other digital services provided by tech companies to users within a specific jurisdiction.

The primary objective of DST is to ensure that digital companies, which often operate across borders, pay their fair share of taxes in the countries where they generate significant income. To provide a comprehensive view, here’s a list of countries with DST policies and their corresponding rates:

France: France was among the first countries to implement the digital services tax. In 2019, it implemented a 3% tax on revenues from digital services.

Canada: Following the global trend, Canada also joined the league of countries that introduced digital services tax. It imposes a 3% tax on certain online revenues.

United Kingdom: The United Kingdom introduced the digital services tax in 2020, and the government imposes a 2% tax on revenues generated from social media, search engines, and online marketplaces.

Italy: Like the UK, Italy implemented DST in 2020, levying a 3% tax on specific digital services.

Spain: In 2021, Spain introduced DST and charged a 3% tax for digital services.

Other countries, including India, Turkey, Austria, Indonesia, and Hungary, have also implemented digital services, ranging from a 1% to 30% tax rate. These countries implemented digital services tax as a temporary measure until a global tax framework could be implemented.

As the digital services tax is implemented in specific jurisdictions, the guidelines for its application can vary significantly. To prevent confusion among sellers, Amazon has introduced a fixed fee structure called the Digital Services Fee.

It is already apparent from the discussion above that Amazon’s digital services fee is Amazon’s response to the digital services tax implemented by several countries, including Canada, the United Kingdom, France, Italy, and Spain. This new Amazon selling fee affects the cost of items Amazon sellers sell in certain countries and stores.

It is important to note that the Amazon DSF is built on two key components, providing a predictable structure for sellers to plan their business strategies. These components are:

The Amazon DSF is applied as a percentage increase, not directly to the item price, but to the following per-unit fees:

fee, and get-paid-faster fee

For example, if your business is established in the United States and you are selling an item in the UK store (amazon.uk), you can expect a 2% digital services fee to be applied to Selling on Amazon fees and FBA fees. While this fee may seem like an additional cost, it is a predictable and manageable charge for the services provided.

For instance, if the referral fee is £2.25 and the FBA fulfillment fee is £3.30, a 2% DSF will be added to each of these Amazon fees.

£2.25 (referral fee) x 2% (DSF) = £0.045

£3.30 (FBA fulfillment fee) x 2% (DSF) = 0.066

£0.066 + £0.045 = 0.11 is the Digital Services Fee

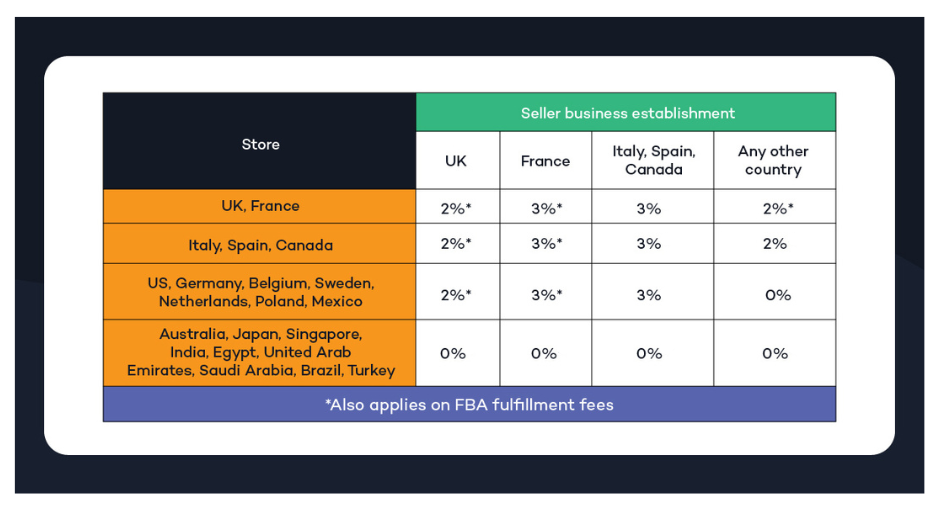

To simplify the impact of the digital services fee, here is a breakdown of how it will affect sellers with businesses established in specific countries:

If your store is established in the UK, a 2% digital services fee will be added to your Selling on Amazon and FBA fees for sales in other Amazon stores, such as the UK, France, Italy, Spain, Canada, United States, Germany, Belgium, Sweden, Netherlands, Poland, and Mexico.

If your business is established in France, a 3% fee will apply to your Selling on Amazon and FBA fees for sales in stores such as the UK, France, Italy, Spain, Canada, United States, Germany, Belgium, Sweden, Netherlands, Poland, and Mexico.

If your store is based in Italy, Spain, or Canada, you’ll also face a 3% fee on your Selling on Amazon fees for sales in the UK, France, Italy, Spain, Canada, United States, Germany, Belgium, Sweden, Netherlands, Poland, and Mexico.

If your store is in any other country, a 2% fee applies to your Selling on Amazon and FBA fees for sales in the UK and France, and a 2% fee for sales in Italy, Spain, and Canada and this will only be applied to Selling on Amazon fees.

Businesses established in a country that has not introduced a digital services tax will not be charged fees. Moreover, the digital services fee will not apply to Amazon sellers who do not sell in the UK, France, Italy, Spain, and Canada stores.

Amazon has provided a table for reference, making it easier for Amazon sellers to digest this new Amazon fee update. You can check the table below:

Table Adapted from Amazon Digital Service Fee Page

The Amazon Digital Services Fee (DSF) will affect international sellers operating in Amazon’s US stores and countries with Digital Services Tax (DST). The introduction of the DSF aims to provide a clearer and more predictable fee structure for sellers regarding their Amazon selling fees.

It is important to note that the digital service fee, which will be implemented on October 1, 2024, does not affect domestic sales for Amazon businesses established in the United States and likewise selling in the US store (amazon.com).

By understanding how the digital services fee is applied and where it affects your business, you can stay ahead of the changes and maintain profitability. Utilizing Amazon’s tools, such as the Revenue or FBA Calculator and Amazon repricers, will help you monitor these fees and make informed decisions about your pricing, sales, and expansion strategies.

Repricers and automation tools are pivotal in helping sellers adapt to the DSF. They are instrumental in ensuring businesses remain competitive while safeguarding their profit margins.

Set up in minutes with the help of our customer success team, or reach out to our sales team for any questions. Start your 15-day free trial—no credit card needed!